By Patton VanVeckhoven

Parties to a real estate transaction are often surprised to discover, via a survey or title commitment, that a fence or other structure actually crosses a property boundary line, creating the potential for a question of ownership.

Title companies generally will not insure title to strips of land between boundary lines and fences, causing potential for barriers to closing. The title commitment will take exception to coverage in Schedule B with an exception similar to the following:

“Any claim, right, or assertion of title by the adjoining land owner in and to that strip of land located between the property line and the fence, as shown on survey dated 2/6/2017…”

One reason title companies make this exception is that the neighbor’s use of the property may have developed into a claim for adverse possession, or into a prescriptive easement, among other reasons. Title companies will generally remove the exception if furnished with a boundary line agreement between the owners of the two properties, in which both parties agree that the boundary line is the line shown on the survey and not the fence line.

Further, the owner who has the structure encroaching on the property will also be required to waive any interest he may have in the strip of land at issue.

As a buyer, it is important to engage an attorney to thoroughly review both your title commitment and survey, as well as any HOA documents that may exist. Once you buy the property, any question or dispute is now your problem and could lead to costly litigation.

In most cases, both parties will not mind signing the boundary line agreement, because neither party likely realizes the error and neither party wants to go through the trouble, burden and expense of making such a claim.

In the event the seller and corresponding neighbor refuse or are unable to enter into a boundary line agreement, the buyer will likely have the option under the purchase contract to terminate the contract.

Because it may take some time to have the boundary line agreement agreed upon and executed by the neighbor, a real estate attorney should be engaged to prepare the agreement as soon as the boundary line issue is detected, as well as review the rest of the title, survey and HOA documents.

This class filled up so quickly, we have added another one on 1/27 at 1:30-3:30 pm. To Register just call ABoR at 512.454.7636.

The Hay Legal Group PLLC is now listed among Independence Title Company’s escrow agents for the new Zoccam mobile app.

Zoccam offers agents the ability to safely and securely send the contract and earnest money from anywhere.

- Zoccam Saves Time – send the contract and earnest money from anywhere at any time, without driving all over town.

- Zoccam Is Easy – capture the check image in seconds from your phone or tablet and receive immediate email notification letting you know the earnest money was delivered.

- Zoccam Is Secure – the check is encrypted from capture to delivery. There is no financial information or check image kept on your phone.

Just download the app for iPhones or Android phones and begin working smarter, not harder.

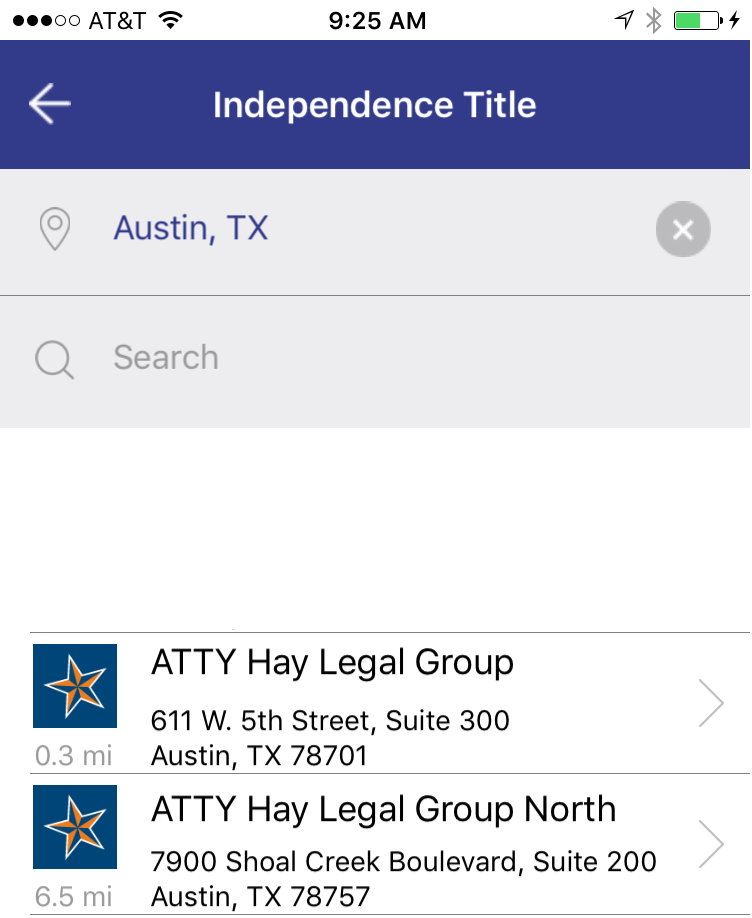

After downloading the app and registering, you select escrow officers. Just choose one of The Hay Legal Group offices from the Independence Title list, as pictured below. BE SURE THE CHECK IS MADE PAYABLE TO INDEPENDENCE TITLE COMPANY.

And now there is a NEW Zoccam Feature which allows a Realtor to invite their buyer (who is out of town or unavailable) to use Zoccam to take an image of the earnest money check and submit the order.

How do Realtors get it? This feature is in the newest update for both iPhone and Android devices. Realtors will want to make sure the current version being used is 2.2.1. Depending on their phone settings, this update may be automatic or they may have to manually go to the App store or Google Play to download.

They can confirm they have the update by going to the menu in the app and choosing “About”. Here they will see the Production version at the bottom of the screen. Also, if they are on the home screen, they will know that they have the newest version as they will now see an additional option to choose “Enter ZCode” above the “Send Earnest Money” option.

How does it work?

REALTOR:

- The Realtor will choose “Send Earnest Money,” enter in all the order information as usual and attach the contract (attaching contract is still optional).

- The Realtor must enter the buyer’s email address as this is how the buyer will receive the invite and code.

- Once contract information is entered, instead of moving on to take the image of the check, the Realtor will choose “Buyer Capture” as opposed to “Check Capture” and is asked to enter the buyer’s mobile phone number and send. This sends the buyer an email invite with the ZCode and a link with instructions on the process.

- Data and contract are held in a queue and are not sent until the buyer takes an image of the Earnest Money and completes the process.

BUYER:

- The buyer opens the email and is instructed to download the app.

- They register by entering their mobile phone number in place of the license number. They do not need to enter any other information.

- The buyer receives a four-digit code via text, will enter the code and create a PIN.

- Next choose “Enter ZCode” and enter the ZCode from the email.

- They are taken to the contract detail screen which contains the information already entered by the Realtor.

- The buyer will take an image of the check-front and back, confirm the information and send the order.

- Note: This is for a one-time use only.

- All parties receive their email confirmation as they do today and the transaction is now complete.

So Zoccam is now easier than ever for both the buyer and Realtor.

Drive Success Not Checks!

The Hay Legal Group PLLC hosted a Supper Club this week for residents of Spring Terrace apartments, one of the Foundation Communities’ facilities. Team members prepared and served a great dinner for more than 40 residents.

As part of our Help – Lead – Give volunteer program, this is one of the monthly events we sponsor to encourage our employees to give back to the community.

“It was a great time and rewarding experience. I’m so glad that The Hay Group offers us these opportunities to participate in the community,” said Brian Walsh.

Managing Partner, John A. Hay III, is one of the nominees for Austin Business Journal’s Best CEO Awards program. Winners in each category will be named at the invitation-only ceremony on Thursday, September 22.

“Running a company, no matter the size, requires a delicate balance of accountability and compassion,” said Will Anderson, ABJ Digital Editor. Mr. Hay is nominated in the category of companies under $10,000,000 in revenue.

“I am honored and humbled to be nominated among this distinguished list of local CEO’s,” John Hay said. “The outstanding team of professionals at The Hay Legal Group PLLC all contribute to our success everyday.”

by Hay Legal Group

As Austin’s population continues to explode, many developers seeking to maximize lot space have leveled-single family homes and replaced them with two-unit condominium buildings. Additionally, many owners of multi-family buildings, such as apartment complexes and duplexes, are converting the buildings into condominiums, to allow for units to be sold separately and capitalize on the current seller’s market.

The process of establishing a condominium regime for new construction is similar to the process of converting an existing building into condominiums. The Texas Uniform Condominium Act (“TUCA”) governs Texas condominium regimes, and the following documents must be in strict compliance with TUCA.

There are three sets of documents involved for each process:

-documents related to the condominium owners’ association;

-documents related to the Condominium Declaration, including a condominium survey

-documents related to conveyance.

A key distinction with conversions is that conveyances of the newly created condominium units are made subject to existing leases. A key distinction with new construction is that a transfer of the Owners’ Association management is likely to take place at, or soon after, closing, whereas conversions often involve the building owner maintaining control of management until a certain percentage of condominium units are conveyed.

Because of the strict requirements of TUCA, owners and investors seeking to create condominium regimes should consult with a real estate attorney and surveyor experienced with condominiums. Additionally, a commercial insurance agent will need to be involved in the process.

The Hay Legal Group PLLC prepares condominium documents on a flat fee basis, which includes filing fees with the Texas Secretary of State and the county clerk’s office. For more information on our firm and how you can engage us to represent you in your real property matters, please contact our office at 512.467.6060.

Texas Association of Realtors® Now Offers Form TAR 2516

By now REALTORS® know TRID (TILA-RESPA Integrated Disclosure) changed the world for residential real estate transactions dramatically. The Texas Association of Realtors® recently implemented a uniform document called “Authorization To Furnish TILA-RESPA Integrated Disclosures” – TAR-2516 – specifically to allow consumers to authorize their REALTORS® to receive the Closing Disclosure (or CD).

By providing written permission authorizing the title company and lender to share the CD with the REALTORS® on a particular transaction, this TAR Form 2516 will loop agents in early to address any potential errors, as well as help explain questions of the borrower.

Previous to the implementation of the CD, the HUD-1 Settlement Statement would be made available to the REALTORS® allowing them to be involved in these same proactive tasks. However, the changes made by the Consumer Financial Protection Bureau (CFPB) in October prohibit allowing dissemination of the CD without specific written consent of the borrower.

TAR-2516 allows for this specific written consent and REALTORS® should discuss with their clients whether they will allow the REALTOR® to be involved in the CD. If so, this form should be considered a must.

If the borrower chooses to involve the REALTOR®, the parties should get this form executed early in the process and – immediately upon execution – provide it to the title company, escrow officer and lender, which allows for any processing needed to add the REALTOR® to the distribution group(s).

Click here for a link to the TAR-2516 can be found in ZipForm or on the Texas Land Title Association website.

By Patton VanVeckhoven

The 1031 Exchange derives its name from Internal Revenue Section 1031, which allows sellers to defer taxes on gains of the sale of property by reinvesting into like-kind properties.

Currently, high-income investors are subject to a 20% long-term capital gains tax, and an additional 3.8% net investment income tax to finance the Affordable Care Act. So an investor that purchased property in 2009 for $400K, and sold it today for $700K, could be liable for taxes of more than $70K on the $300K gain. This is where the 1031 Exchange comes to the rescue.

The basic requirements for a 1031 exchange are:

- The property must be held for business or investment use: Rental properties, raw land, and net leased properties all qualify, but fix & flips, primary residences, inventory, stocks and bonds do not. There is no established hold time, but if the exchange is ever audited, the IRS will look to whether the intent of the exchanger was to hold the property for investment purposes, as opposed to flipping it, so the longer the hold time, the better the chance the exchange will be allowed.

- The replacement property must be of a like-kind: Real property may be exchanged for other types of real property, e.g., residential rental property may be exchanged for farmland or an office building, but not for personal property. Tangible personal property, such as a fleet of trucks, may be exchanged for other tangible personal property, such as an airplane.

- The replacement property must be identified within 45 days of closing the relinquished property: The identification must have a specific description and be in writing. Multiple properties may be identified, as long as their aggregate fair market value does not exceed 200% of the sales price of the relinquished property. However, the property purchased must be 95% of the value of the properties identified.

- The replacement property must be of equal or higher value: Any gain will be taxed. The difference in value, known as “boot,” can consist of cash or a reduction in your mortgage, so if you don’t receive equity or cash, but your mortgage liability is reduced, the reduction will be taxed as “boot.”

- The exchange must be completed within 180 days: The replacement property must be closed on within 180 days of the closing of the relinquished property.

- Qualified intermediaries: The IRS provides that the exchanger must use a qualified intermediary (“QI)”, also known as an exchange accommodator, to hold onto the proceeds. If a disqualified party takes possession of title or the proceeds, the exchange will be disallowed.

Prior to selling an investment or business property, you should consult with your tax adviser as to whether a 1031 exchange makes sense. You may be eligible for offsets that leave you with a negligible capital gain. In addition to consulting your tax advisor, you should consult a real estate attorney regarding the conveyances involved with the exchange; our attorneys at The Hay Legal Group PLLC can help.

In summary, the 1031 exchange is a fantastic tax saving tool available to parties looking to convey business or investment property, and the proper professionals should be contacted to ensure that the above rules are strictly complied with.

Remember, it’s not what you make on the sale, it’s what you keep!

CFPB: INTEGRATED DISCLOSURE FINAL RULE

John Segrest of Old Republic National Title Insurance Company today presented an overview of the rule and upcoming changes, at The Hay Legal Group’s newest North Austin office. Special thanks to John Burnam and Shiloh Glaze from Legacy Mutual Mortgage for sponsoring the class.

Sponsored by

The Hay Legal Group PLLC is delighted to introduce our newest team members for our North Austin office, located at Shoal Creek Blvd at Anderson Lane, on the second floor of the Bank of America building.

Joy Stokes, Branch Manager/Escrow Officer

Joy, a veteran of the Austin title industry for many years, brings a broad knowledge base of the Central Texas Real Estate market.

With experience in all kinds of real estate contracts, from Residential to Commercial transactions – from Farm & Ranch to Development properties, she will head the office at 7900 Shoal Creek Blvd, STE 200. Learn more about Joy…

Melissa Garcia, Escrow Processor

With more than 10 years’ experience in the title business, Melissa started in the industry to close mostly builder files and assisting with Spanish translations.

Her knowledge of many types of real estate transactions, plus several years in customer service in the financial services industry help her keep clients informed throughout the closing process, ensuring a smooth closing. Learn more about Melissa…

“We are delighted to have Joy and Melissa join our team of experienced title professionals. They bring the knowledge and expertise, plus a can do attitude to lead our newest location,” said John Hay III, Managing Partner of The Hay Group.

Located near MoPac and Hwy. 183, the newest office is convenient for North Austin, Round Rock, Cedar Park, Pflugerville and Georgetown.