We are here and ready to help close your deals in a timely and efficient manner, while doing our part to help stop the spread of COVID-19. Over the past six weeks our amazing team worked together to implement policies and procedures to limit contact wherever possible. We are also working in limited numbers in the office and have most staff working remote.

New Contracts:

- Earnest Money – A buyer may electronically wire funds or use our easy app Zoccam to send the Earnest money.

- Option Money – We will not be coordinating these funds and encourage buyers/sellers to use PayPal, Venmo or similar means. We are happy to facilitate the signatures as needed to receipt.

- Ongoing contracts: Our entire team is working digitally and is handling every aspect of contract-to-close.

Closings:

- Funds to close should be wired if at all possible.

- We are utilizing our downtown location front closing room which is immediately across from the elevator.

- There are no multiple closings in the office at the same time and the room is wiped down after the conclusion of each group.

- The room is glass and will allow our staff to stay in the adjoining space and available to talk but not be in direct contact with the customer.

- We will watch the signing and then notarize after you leave the space.

- For anyone who is uncomfortable leaving their home or otherwise unavailable we will gladly assist with one of our notary partners to come to you at a pre-negotiated price.

We are here for our referral partners, clients and customer and are doing our part to assist in combating the spread of this terrible virus. Thank you to everyone for the ongoing support – we are here for you!

By John Hay

The Texas Real Estate Commission (TREC) implemented new promulgated forms earlier this spring which became mandatory May 15, 2018. Over the next few days we will explore many of the changes that are now a part of the TREC promulgated forms.

Contract Changes: Paragraph 5

The most specific requirements added to the contract are defining Effective Date (now a capitalized/defined term = means terms/obligations are specifically tied to the date) and “TIME IS OF THE ESSENCE”. Time is of the essence is a legal term of art which makes time in a certain part of a contract specific and actionable if not complied with by the required parties. Alert! The buyer MUST DELIVER THE EARNEST MONEY within 3 days after the Effective Date = Excluding weekends or legal holidays, this is a hard date. Buyers and real estate agents, it is critical to work with a title company who you trust to work hard, comply with the contract, properly and timely receipt the earnest money and lastly understand what is discussed in this section. If it is not tendered, the seller may terminate the contract WITHOUT discussion or warning. Period! If a buyer tenders after the date, and before a proper termination by the buyer, the contract remains in effect. These changes are a result of buyers failing to tender earnest money or the “check’s in the mail” but still wanting to have the protections and benefits under the contract. It is the buyer and buyer’s agent responsibility to monitor these dates.

BEST PRACTICES: be sure the Effective Date is accurate. Consider using a wire, FedEx or an app such as ZOCCAM to receive instant confirmation of delivery, or hand deliver. Reminder it is the date is based on delivery, not when mailed/sent.

NOTE: the option fee is also required in the same time frame and carries the same time is of the essence requirements, but in the option fee situation if it is not tendered timely paragraph is omitted from the contract and the buyer DOES NOT have the option to terminate.

Pay attention and review page the (new!) page 10 of the contract where Option Fee, Earnest Money, Contract Receipt and Additional Earnest Money are all split out with the DATE included.

By John Hay

Recently, an article by MarketWatch highlighted the importance of having a Will: “Why you need to write a Will now, even if you’re not ‘rich’”

In my view, the article is spot on for several reasons, including the following.

A properly executed Will:

- Makes life easier on your family after your death;

- Gives you, and not the State or a Court, control over your assets;

- By appointing a Guardian, formally gives you a say in who takes care of your minor children;

- Helps avoiding the confusion on who actually gets what (is your Ex still on your Life Insurance Policy?);

- Specifies trusts that can protect heirs from themselves!

However, the article does come up short, specifically in some of the following important estate planning nuggets. A properly drafted, executed and witnessed Will:

- Is able to transfer Home Ownership with minimal additional work often required by a Title Company to sell the real estate;

- Creates a catchall to obtain funds or accounts you might have overlooked or not had at the time of the execution of the Will. When was the last time you checked out the unclaimed property website?

- Specifies how you want your remains and final wishes handled. While being propped up beside the jukebox might not be enforceable, the amount of strife between surviving siblings/spouses/parents about who “really knew what you wanted” for your burial is as endemic as clashes about money.

Lastly, a properly drafted, executed and witnessed Will package also includes estate planning documents as well-designations of guardians, power of attorneys, medical power of attorneys, and medical directives, among other documents. Translated into regular English, if you were to have a medical emergency, is someone designated to make critical medical decisions for you?

By John Hay

There is actually an ad-valorem tax benefit that awaits you when you turn 65. In addition to the General Residential Homestead Exemption available to most residential homeowners on primary residence properties, homeowners of at least age 65 may be entitled to an additional tax exemption commonly called the “Over 65 Exemption”.

To obtain such an exemption, the homeowner must apply for an application with the Central Appraisal District (CAD) of the county where the property is located. As a part of the Application for Residence Homestead Exemption, Form 50-114, the Over 65 designation carries similar requirements to prove qualification and also requires the signature to be notarized in many counties.

The application must be fully completed (even if you already have a Homestead Exemption on file). Some counties even have online filing options for easy use.

The application is a one-time cost-free filing and may be submitted on January 1 or later in the year where the owner turns age 65. When approved by the county, the Over 65 exemption results in a tax ceiling for certain ad valorem assessed taxes…and in many jurisdictions this includes the school district taxes which typically make up the largest portion of property taxes.

However, if you remodel, add square footage or a garage or complete other significant improvement, the ceilings may rise. It is also possible (and fairly easy) to transfer your Over 65 tax ceiling to a new property by filing a Request to Cancel/Port Exemptions form.

If you have any questions about residential property tax exemptions, including a possible extension of the Over 65 Exemption for the surviving spouse who is over 55 years of age when the older spouse passes away, please do not hesitate to call our office.

By Patton VanVeckhoven

Parties to a real estate transaction are often surprised to discover, via a survey or title commitment, that a fence or other structure actually crosses a property boundary line, creating the potential for a question of ownership.

Title companies generally will not insure title to strips of land between boundary lines and fences, causing potential for barriers to closing. The title commitment will take exception to coverage in Schedule B with an exception similar to the following:

“Any claim, right, or assertion of title by the adjoining land owner in and to that strip of land located between the property line and the fence, as shown on survey dated 2/6/2017…”

One reason title companies make this exception is that the neighbor’s use of the property may have developed into a claim for adverse possession, or into a prescriptive easement, among other reasons. Title companies will generally remove the exception if furnished with a boundary line agreement between the owners of the two properties, in which both parties agree that the boundary line is the line shown on the survey and not the fence line.

Further, the owner who has the structure encroaching on the property will also be required to waive any interest he may have in the strip of land at issue.

As a buyer, it is important to engage an attorney to thoroughly review both your title commitment and survey, as well as any HOA documents that may exist. Once you buy the property, any question or dispute is now your problem and could lead to costly litigation.

In most cases, both parties will not mind signing the boundary line agreement, because neither party likely realizes the error and neither party wants to go through the trouble, burden and expense of making such a claim.

In the event the seller and corresponding neighbor refuse or are unable to enter into a boundary line agreement, the buyer will likely have the option under the purchase contract to terminate the contract.

Because it may take some time to have the boundary line agreement agreed upon and executed by the neighbor, a real estate attorney should be engaged to prepare the agreement as soon as the boundary line issue is detected, as well as review the rest of the title, survey and HOA documents.

The start of a new year is a time for reflection on the successes and challenges of the prior year and focusing forward to the goals ahead for the year. In recent weeks, two important annual economic forecasts for Central Texas were presented in Austin. The Homebuilder’s Association of Greater Austin (HBA) with the Austin Board of Realtors (ABoR) and AngelouEconomics with Austin Business Journal both presented economic forecasts for the Austin area.

Some highlights from the two events are below, with more information found in the links to the full presentations.

The HBA of Austin and ABoR event featured 3 speakers. Some of the key points from their presentations include:

Dr. Greg Hallman, Senior Lecturer of Real Estate: The University of Texas – Austin. Full Presentation

- Employment growth in Texas much higher than the Nation, with 25% increase since 2006;

- Austin average increase of approximately 40,000 jobs annually since 2006, with an unemployment rate of 3.5%;

- Applying traditional economic indicators, the United States and especially Texas are in very good shape for continued employment growth.

Colleen Sharp, VP and Associate Head of Insights Integration: Kantar Futures. Full Presentation

- The impact that digital technology has on consumers’ ability to connect and communicate, fuels the need of convenience and lifestyle utility in homes and communities;

- Blurring of defined assumptions provides an opportunity to leverage growth by targeting emerging consumer groups;

- Increased consumer desire for belonging is key for homebuilders to build community and create spaces and experiences that link the desire for individuality with belonging.

Eldon Rude, Principal: 360° Real Estate Analytics. Full Presentation

- Housing starts in 2017 expected to increase 5-8% from prior year, still short of demand;

- Lack of active listings in MLS and low new home starts will continue to put upward pressure on home prices throughout the market;

- In the rental market, Austin-wide average rent of $1.41/sf reflects a 5%+ increase in the last 12 months, 12% increase in the past 24 months.

AngelouEconomics and the Austin Business Journal presented their forecast in digital format, for the first time in 33 years. Some key takeaways follow. Full Presentation.

- More than 100,000 new residents will arrive in Austin metro area in the next two years, raising the total population close to 2.2 million by year end 2018;

- The population and economy will continue to grow while slowing slightly, allowing housing and labor markets to catch up – 2.6 times more housing sales than starts in 2016;

- Key indicators continue showing strong economic growth:

Population Growth +3.2% – Employment Growth +3.3% – Retail Growth +9.2% – Business Growth +3.6% – Average Wage +2.9% – Unemployment +0.2% – Housing Starts +16.8%

- Housing Inventory and Affordability: Inventory Crisis

- Building permits back to pre-crisis level

- Housing starts have been short for the last 9 years

- Should be building 15,000 homes/yr to keep up

- Economic Drivers: The Tech Sector

- Tech employment increased 28% since 2011

- Tech represents over 22% of total employment growth since 2011

- Average salary for industry exceeds $84,000/yr

- Economic Drivers: The Festival Economy

- Annual Impact – COTA: $1 Billion, SXSW: $320 Million, ACL Festival: $220 Million;

- Tourism also provides huge boost in the economy without long term effects of population growth, such as housing affordability and sustained congestion.

- Central Texas Regional Challenges:

- Traffic – Austin 7th worst traffic nationally

- Affordable Rental and Single Family Homes – low inventory and low housing starts impact affordability

- Job growth and Quality – keep pace with cost of living

- Commercial Real Estate Affordability – high rent puts pressure on wages

By Colin Newberry, Attorney at Law

This question is one we see often, as sometimes well-intentioned actions can lead to unintentional consequences. Oftentimes a couple will buy a house together without being married. OR, a homeowner will add a boyfriend, girlfriend, partner, or fiancé to a property title.

Unfortunately, once a person is added to the title of a house, it is no longer just your house. You share ownership with that person, and it is, to use Texas legal jargon, Y’alls House. Even if you are the only one responsible the mortgage on the home, this can lead to trouble down the road, if you did not prepare properly from the get go.

Mind you, this isn’t just for people who were in a relationship. I’ve handled partition suits for siblings who inherited property together via probate, investors who are divesting themselves of property or the business relationship, or in one rare case, between a mother and her child who inherited an interest in a property from the child’s deceased father.

What are the things to keep in mind when approaching the division of a jointly owned, and jointly mortgaged, property? A few things to consider:

- -Is it divisible in kind [physical division] or by sale only?

- -Does someone want to stay in the property, or otherwise keep it? Of course, if one person is staying and one person is going, that opens up a whole other bucket of questions.

REMOVAL FROM THE MORTGAGE AND EQUITY REIMBURSEMENT – The two biggest obstacles to partitioning a property

Release from Mortgage: The bank doesn’t care that you don’t own the property anymore; they care that they have two guarantors to go after if the loan falls into default. This is true regardless of whether you are married. Even in an amicable partition, the refinancing or releasing of a party from a mortgage is the most difficult step.

Understandably, anyone who is giving up their interest in a property doesn’t want to have that loan on their credit report, much less be liable for the other owner’s failure to pay the mortgage. When a mortgage cannot be removed as to one property owner – whether because of financial constraints or bank requirements – all that is left for the cautious owner to do is to insist on the sale of the property to satisfy that loan.

Reimbursements of equity: Whether agreed to be sold or forced through a partition sale, the allotment of profits, should there be any, is the most contentious part of any partition. So, who gets money for what? The answer is complicated, but there are certain areas of reimbursement that ring true across all issues:

- -Down Payment: Was the property co-owned at purchase, or was a second owner added to Title after purchase?

- -Mortgage: This obligation is for both owners, regardless of who is on the note. If one owner doesn’t pay, they should owe from the proceeds of the sale.

- -Necessary repairs: If one owner has to make a repair to maintain the condition of the property, then should they get reimbursed for that repair or split the cost?

- -Improvements: Should one owner agree to another owner about improving the property, then it is possible to have the expense of that improvement reimbursed.

With any situation, however, the cost of determining value, reimbursements, and ownership can quickly surpass the value in the home. It is almost universally better to set aside the emotions of whatever relationship existed when the property was purchased, and divide up the property under the relationship as it stands now with a dry, business approach.

THE BEST EXIT STRATEGY HAPPENS AT THE INCEPTION OF THE JOINT INVESTMENT

An even better exit strategy is to have a plan at the inception of the purchase. Called a co-habitation agreement, purchase-sale strategy, or even an Agreement in the Company Agreement should the property be bought by an entity, this document serves as a Pre-Nup for Property Ownership. It states who stays and who goes, how notice is given, how reimbursements are determined, and sets timelines for refinancing or if necessary, pricing, realtors, and timetables for listing and selling the property. This contractual arrangement may seem like an uncomfortable conversation at the time, but is a necessary evil for anyone going into a significant investment with a partner you are not married to.

Back to the Question: How to dissolve this joint ownership? The worst case answer is a Suit for Partition with a judicial determination of reimbursements and equity. The best case scenario is a practical business conversation regarding your investment. The preferred scenario is to have that conversation while things are still in the beginning, optimistic stages of ownership in the form of a co-habitation agreement previously discussed.

No matter what route you take, or are being taken on, one fact remains true. This area of law is complicated and merits the investment of an experienced attorney to guide you through your options to ensure you get the best possible result.

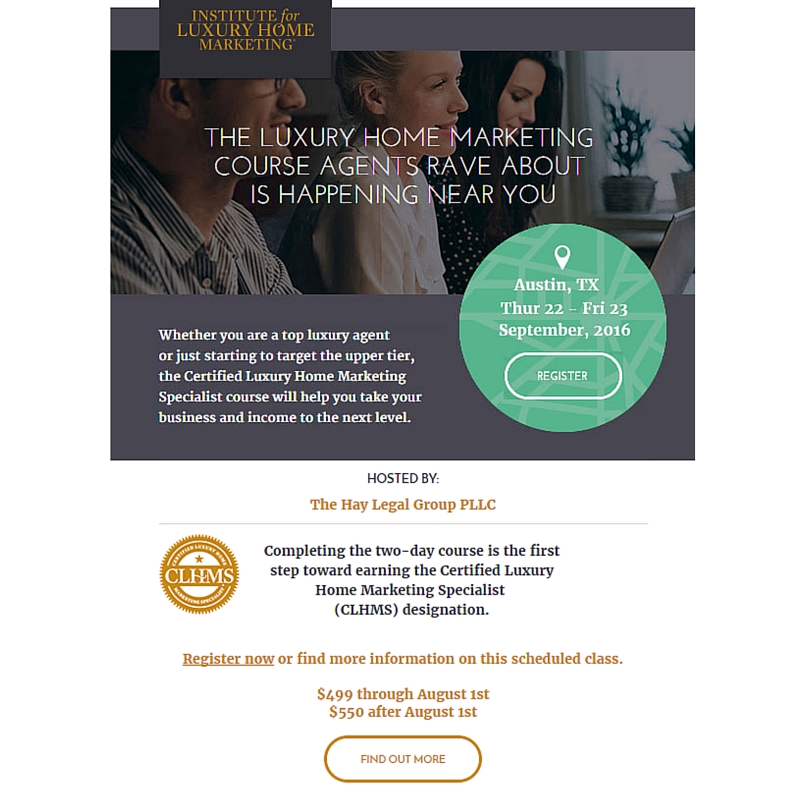

Don’t miss out: The luxury home marketing course that drives success! Sign up today and get an Early Bird discount until 8/1/16!

John A. Hay III, Managing Partner

Property values in Central Texas and all across the State continue to rise, so what does this mean for your ad valorem taxes, commonly referred to as property taxes? It means that the appraised value, by which the County derives your tax bill at the end of the year, is likely higher than it was in 2015.

How is this calculated? What can I do about the valuation? Below is a brief summary of the process related to Travis County, which is the same throughout Texas counties.

First, how is the value of your property determined?

The county’s appraisal district calculates the value. In Travis County, the Travis Central Appraisal District (“TCAD”) website is where you can search for values and other information for properties, as well as gather forms and related information from TCAD. Their website is informative and easy to navigate, but be aware many counties are behind the curve.

The appraisal district is charged with valuing property and generally their information comes from a few places. In Travis County:

- -TCAD monitors recorded documents as they are posted with the Travis County Clerk. These include your deed and deed of trust among other things. It is important to not place the sales price in a deed, which sometimes is done in a cash situation.

- -Then TCAD uses its own eyes, through monitoring of building permits and improvements, to set values based on its own observations.

Note: When you buy a property, TCAD will send you an information statement asking you to disclose what you paid for the property. YOU ARE NOT REQUIRED TO COMPLETE THIS FORM and I suggest that you rarely do, as it provides unnecessary information that may be used to your disadvantage down the road.

With all that being said, the values are set by applying blanket factors or codes relating to the property such as lot and structure size, neighborhood, condition, proximity to freeways, and green space – just to name a few, stirring them in a big pot, and out comes your value.

As improvements are made or codes for the neighborhood are changed, so does the method by which your appraised value is calculated. Thus, sometimes you may see a large jump or decrease in your value that on the face may not look to be commensurate with your perception of the value.

Second, how do I fight or correctly termed, PROTEST, the value placed on my home by the appraisal district?

Time is of the essence as most protests need to be filed by May 31st or no later than 30 days after the appraisal district mailed you a notice of appraised value, whichever is later. The filing of the protest is fairly simple.

First, complete the Protest Form and be sure to indicate your correct appraisal district on the top of page one. With this protest you only have to complete the minimum information, as rarely does the County simply change your value based solely off the information completed here without at least an informal hearing.

Once you complete the protest form, next gather all your data and information to present your case. You will be notified of the date for both an informal and formal hearing date.

The informal hearing is just as it sounds – you sit down with a representative of the appraisal district and discuss your value and upon agreement, settle on an agreed value. You are not required to go to or notify the county if you will/will not attend the informal hearing.

The next phase – if you do not settle or attend the informal hearing – is the formal hearing.

- -Here, a panel of three people who serve on the appraisal review board acts as the “judges” to conduct the proceedings, listen and to and weigh your evidence, the evidence and rebuttal of TCAD’s appraiser, their own observations, personal knowledge and other factors to decide on a value, including deciding not to change your value.

- -This value is made up of the value of the land and improvements, both of which combine to be your appraised value.

- -Generally, the county is hesitant to make changes in the land value, so you likely will see a change in the improvements.

Should I hire a professional to handle my affairs as related to a property tax protest?

As different firms operate in different ways, ultimately you need to decide if you think that a professional can get the same or better results, without you spending the hours it takes to complete the protest process.

Some firms provide their services at a flat fee value while others charge a % of your savings. You should weigh your goals and the experience and approach of each organization to decide what is best for you.

Important – each property and matter is different and there is no way to predict results. Should you hire someone to handle your property tax protest, you would complete the Appointment of Agent form and indicate your appraisal district on the top of the form.